top of page

SCREW WAITING

.png)

The most direct path to home ownership

-

NO BULL S***

-

AUSTRALIA'S HIGHEST RATED FINANCE TEAM

-

FREE TO QUALIFY

Buy your first home sooner

now

NO LMI

Don't pay for something you can't use. Parker Lane has the widest range of options so you won't pay for something that protects the bank (not you).

NO SAVINGS

Told you need 5%, 10%, 20%? They're living in the past! We help First Home Buyers with clear credit buy a home now at a great rate.

NO STRESS

It's not rocket science. Parker Lane wins awards because they work harder to get you what you want and makes it fun while doing it.

The (nearly) 5-star finance company

Rated 4.9 out of 5 from 1,640+ genuine reviews, Parker Lane has helped more than 7,500 Australian home buyers and homeowners get ahead.

Rent money

is dead money.

Rent money

is dead money

Parker Lane wants you to stop repaying someone else's mortgage and start your financial future today.

Begin here

FHB 101: Buying a 1st home - 2025 Edition

After reading this guide you'll know more about buying your first home than most mortgage brokers and real estate agents combined

Read on

Potential loan amount is calculated based on a hypothetical mortgage of 30 years at an interest rate of 4.75% p.a. Different rates will change the calculation. This is not an indication of borrowing capacity and should not be relied upon to make a financial decision.

Your 3 numbers in 3 minutes

Take the free online quiz.

In just a few minutes find out how much you could BORROW, what DEPOSIT you'll need and what it will cost in REPAYMENTS.

Why owning your home matters

Property makes up 67% of Australia's household wealth. If you're like most people, it will probably be your most important decision too.

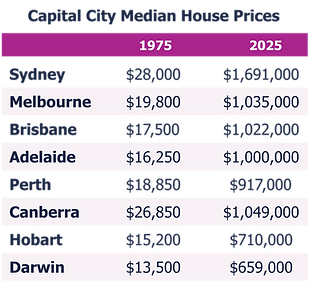

Growth: Property prices double every 7 - 11 years.

Tax: Gains from your home are tax-free.

Rent: Goes up, mortgages get paid down. The sooner you act, the better off you'll likely be.

Leverage: You get to use the bank's money to pay for most of it, while you keep all the rewards.

Why we say SCREW WAITING

There's never a perfect time, but for many, now could be the right time to say 'screw it, let's do it!' Here's why:

-

Interest rates are coming down - Westpac predicts rates to drop much further - adding $89K to the average borrowing power.

-

Prices are on the rise - ANZ predicts prices to rise another 11% by the end of 2026.

-

Government incentives - Across the country, we're helping more first home buyers qualify than ever before.

The direct path to home ownership

1

Get Qualified

Take the 10 minute challenge with one of our friendly first home experts.

2

Get Approved

Once you get qualified we'll lock in a plan and get you approved ASAP.

3

Get a Home

Find a home and we'll take care of settlement so you can relax.

Real solutions, real potential

Sometimes you need more than just a loan to unlock your potential. Explore tailored solutions, specially designed to help you reach your big goals sooner.

How does better finance work?

Parker Lane reverses the traditional finance model. We start with the biggest problems first, understanding the challenges then working with banks and lenders to create superior products and solutions. Our easy process and incredible team make it simple to apply, get approved and get on with life - fast.

1500 +

First home buyers helped

We help thousands of Aussies save money and get ahead every year

2.23 billion kg

of carbon offset*

From projects financed, equivalent to planting about 3.5 million trees

$26 million

back in Aussie pockets

On average customers save $23,504^ with Parker Lane

*Our estimates for lifetime carbon offsets come from the green projects we finance, like solar installations. ^Customer savings are calculated based on average interest rate reductions (compared to market or existing rates) and the added benefits of financed projects. Savings will vary for each borrower but reflect our mission to use finance to help households save money and get ahead.

Hundreds of 5-star success stories just like this one

Vici P

Stockwell, SA

"Excellent Service! – I just wanted to share our positive experience working with the Parker Lane team to obtain a home loan. The process can be overwhelming and stressful, but Keely, Dipesh and Anisha made it so much easier for us. From the initial consultation to the final approval, they were there every step of the way.

They were knowledgeable, patient, and always available to answer any questions we had. They even helped us find the best loan option for our specific financial situation. Overall, I highly recommend working with them for your home loan needs"

Read this and 100's more on productreview.com.au

Frequently asked questions

Trending now in the resource centre

Is now the right time to buy in my market?

The market fluctuates around the country at different times - what time is right for you?

Read on

First home benefits explained

A quick state-by-state guide to what's on offer where you live.

Read on

How much should you spend

The 4 numbers you need to know before setting your budget.

Read on

S

Security matters

Your data is protected by Salesforce Shield, the encryption, monitoring and compliance system trusted by leading organisations in finance, healthcare and government worldwide.

bottom of page